ViX

Introduced in 2004 on Cboe Futures Exchange CFE VIX futures provide market participants with the ability to trade a liquid volatility product based on the VIX Index methodologyVIX futures reflect the markets estimate of the value of the VIX Index on various expiration dates in the future. VIX futures provide a pure play on the level of expected volatility.

While India VIX is expected volatility over 30 days from the current day India VIX futures is expected volatility over 30 days from expiry.

. Volatility Index VIX Futures. Using the Theoretical Futures Prices Tool. Wij willen hier een beschrijving geven maar de site die u nu bekijkt staat dit niet toe.

Expressing a long or short sentiment may involve buying or selling VIX futures. Theoretical futures price can be computed for any day from September 29 2009 till current day. Alternatively VIX options may provide similar means to position a portfolio for potential increases or.

Interactive financial charts for analysis and generating trading ideas on TradingView.

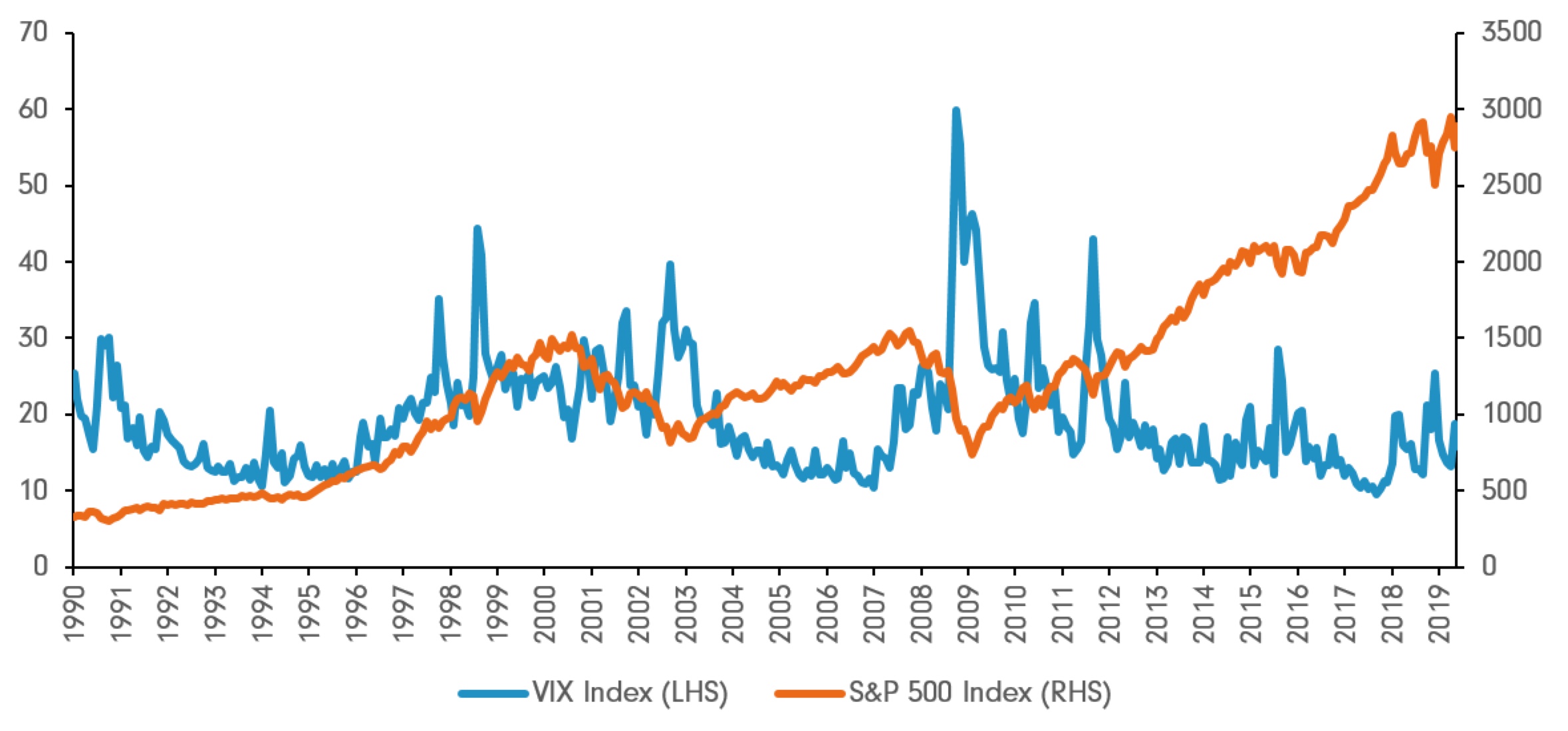

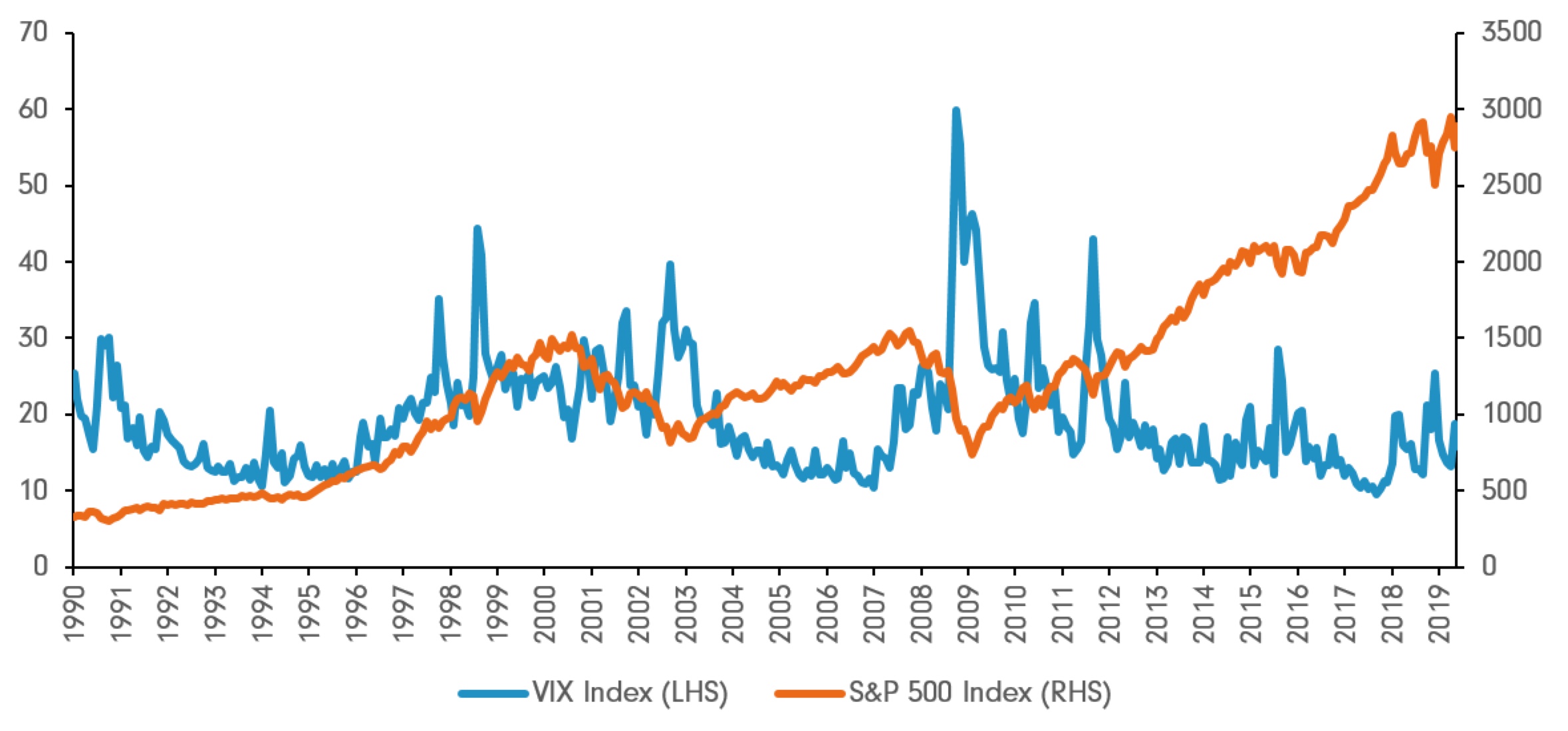

What A Historically High Vix Means For Stocks

10 Key Features Of The Vix Index And New Mini Vix Futures Vxm

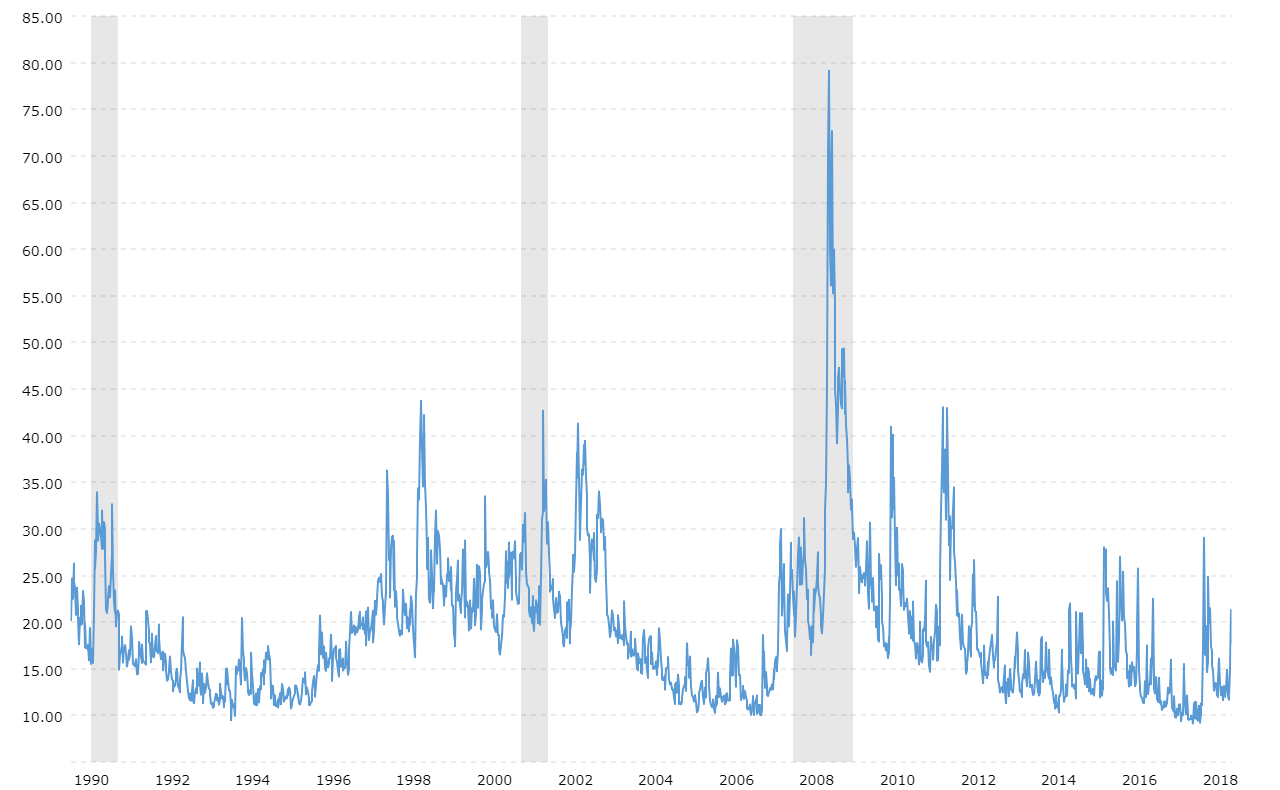

File Vix 2004 2019 Png Wikimedia Commons

Vix What You Should Know About The Volatility Index Fidelity Singapore

/dotdash_Final_Determining_Market_Direction_With_VIX_Jun_2020-01-ac6dfb36d5d745b1a2999315d3e2008a.jpg)

Determining Market Direction With Vix

Vix Volatility Index Historical Chart Macrotrends

Televisaunivision Launches Vix Streaming Brand Phases Out Prendetv Variety

/dotdash_final_Introducing_the_VIX_Options_Dec_2020-01-8170bc60a26540488a929580cc4c4a12.jpg)